Posted on March 15, 2024

We’re all investing to meet specific goals. What we want to achieve varies from one investor to another, but we can likely all agree we want more of our returns going toward our goals—and less to the IRS.

Here are 6 of my favorite strategies for lowering investment taxes.

1. Consider tax-efficient investments

There are many factors to consider when picking investments for your portfolio. When it comes to your nonretirement accounts, 2 such considerations are costs and tax efficiency.

Choosing investments with built-in tax efficiencies, such as index funds—including certain mutual funds and ETFs (exchange-traded funds)—is one way to minimize the tax drag on your returns.

ETFs may offer an additional tax advantage. The way their transactions settle allows them to avoid triggering some capital gains. Because ETFs offer the best of both worlds—low costs and tax efficiency—I often use them as a foundation for some clients’ portfolios.

Note: Index mutual funds track a benchmark, so their goal is to match the benchmark’s performance. If you’re looking to outperform a benchmark, you may want to consider active funds. An advisor can help you review your options.

2. Reduce your taxable income with a health savings account (HSA)

One way to minimize the taxes you pay at the end of the year is to put some of your income into an HSA, a flexible savings account that lets you set aside money on a pre-tax basis to pay for qualified medical expenses. Money you deposit in the current year that you don’t use for qualified expenses remains in the account for future tax-free medical withdrawals. Once you turn 65, you can take penalty-free—but not tax-free—distributions for any reason.

If you’re enrolled in a high-deductible health plan, you’re eligible to open an HSA. An advisor can help you decide if it makes sense to open one.

3. Divide assets among accounts with asset location

Picking tax‑efficient investments is one method to maximize after-tax returns, but you also want to choose the right types of accounts to hold your investments.

At the highest level, asset location is a way to maximize after-tax returns by dividing your assets among taxable and tax-deferred accounts. You can put tax-efficient investments into taxable accounts and investments with a heavier tax burden into tax-advantaged accounts.

Examples of tax-efficient assets taxable accounts should hold

Examples of less tax-efficient assets non-taxable accounts should hold

Index mutual funds, index ETFs, tax-exempt bond funds or individual bonds, individual stocks

Actively managed mutual funds and taxable bond funds or individual bonds

“When I work with my clients, asset location is one of the many strategies we implement to help lower their tax burden.”

4. Look for opportunities to offset gains

As an investor, you’re taxed on net capital gains—the amount you gained minus any investment losses—so any realized losses can help lower your tax bill.

The intentional selling of investments at a loss to lower taxes is known as tax-loss harvesting.1

If you have a year when your capital losses are greater than your capital gains, you can use up to $3,000 of net losses a year to offset ordinary income on your federal income taxes. You can also carry forward losses to future tax years. As with any tax-related topic, tax-loss harvesting has rules and restrictions (such as the wash-sale rule, designed to prevent investors from claiming capital losses as tax deductions if they reenter a position too quickly) you should be aware of before using this method.

If you don’t want to manage tax-loss harvesting alone, enroll in Vanguard Advice and enjoy our automated tax-loss harvesting service.

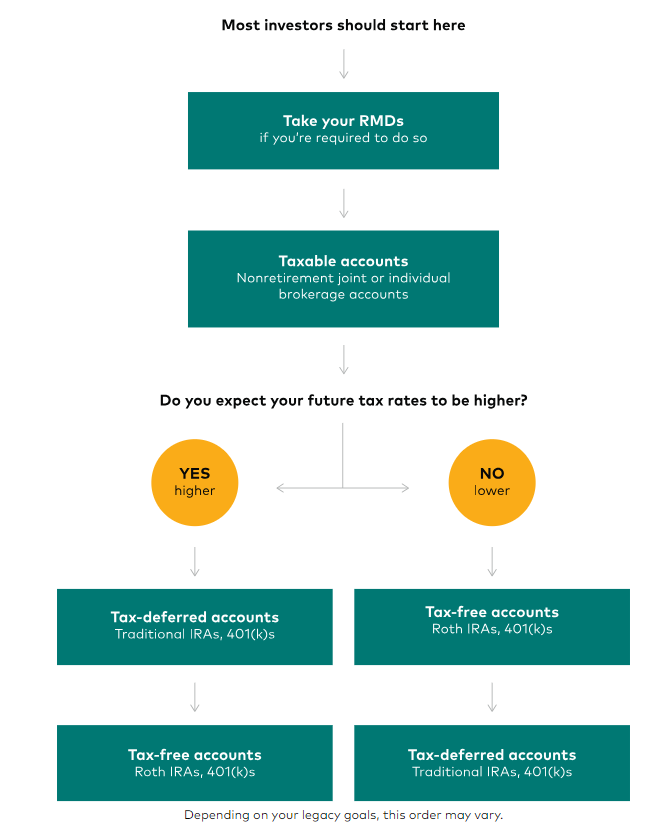

5. Take a tax-efficient approach to withdrawals

When you start taking money out of your portfolio, make sure your withdrawal strategy factors in taxes.

Once you start drawing down from your nonretirement accounts, think about taking all income produced from your investments (dividends, interest, and capital gains) and moving it to a money market account—rather than reinvesting it—so you don’t end up paying taxes twice. If you reinvest the income produced and then sell the shares for a gain, you’ll owe taxes on the income produced and capital gains taxes on the appreciation. A strategy like this is one way I make sure my clients keep as much money in their pockets as possible.

6. Maximize charitable giving

If philanthropy is part of your investment goals, consider these strategies to make the most of it:

- Gift appreciated securities, such as mutual funds, ETFs, or individual stocks, to minimize future capital gains. Not all charities can accept donations of investments, so I often advise my clients to donate through a donor-advised fund, such as Vanguard Charitable, which makes it easy.

- If you don’t take the standard deduction on your taxes, then itemizing cash donations on your return could help you take advantage of tax deductions up to certain limits.

Consider bunching charitable donations together in 1 year so you can itemize them on your return and get a larger tax deduction. - Donate up to $100,000 annually from your IRA directly to a qualified charity through a qualified charitable distribution. As long as certain rules are met (for example, you’re at least 70½ when making the gift and the check is payable directly to the qualified charity), then the distribution shouldn’t be taxable income. A qualified financial advisor can help you decide what’s best.

1Tax-loss harvesting involves certain risks, including, among others, the risk that the new investment could have higher costs than the original investment and could introduce portfolio tracking error into your accounts. There may also be unintended tax implications. We recommend that you carefully review the terms of the consent and consult a tax advisor before taking action.

All investing is subject to risk, including the possible loss of the money you invest.

You must buy and sell Vanguard ETF Shares through a broker, who may charge commissions. Vanguard ETF Shares are not redeemable directly with the issuing fund other than in very large aggregations worth millions of dollars. ETF’s are subject to market volatility. When buying or selling an ETF, you will pay or receive the current market price, which may be more or less than net asset value.

When taking withdrawals from an IRA before age 59½, you may have to pay ordinary income tax plus a 10% federal penalty tax.

Neither Vanguard nor its financial advisors provide tax advice. This information is general and educational in nature and should not be considered tax and/or legal advice. Any tax-related information discussed herein is based on tax laws, regulations, judicial opinions and other guidance that are complex and subject to change. Additional tax rules not discussed herein may also be applicable to your situation. Vanguard makes no warranties with regard to such information or the results obtained by its use, and disclaims any liability arising out of your use of, or any tax positions taken in reliance on, such information. We recommend you consult a tax adviser about your individual situation.

Vanguard’s advice services are provided by Vanguard Advisers, Inc. (“VAI”), a registered investment advisor, or by Vanguard National Trust Company (“VNTC”), a federally chartered, limited-purpose trust company.

Source: https://investor.vanguard.com/investor-resources-education/article/effective-tax-saving-strategies-for-investors

March 05, 2024

Recent Comments