Posted on June 12, 2025

A lack of clarity over U.S. trade policy — with rising tariffs at the center of the storm — has delivered a shock to the global economy. For the first time since 2022, U.S. GDP in the first quarter declined. Some companies stopped issuing forward guidance. Capital expenditures have been delayed. Cargo volumes have plummeted at major ports. Hiring has slowed.

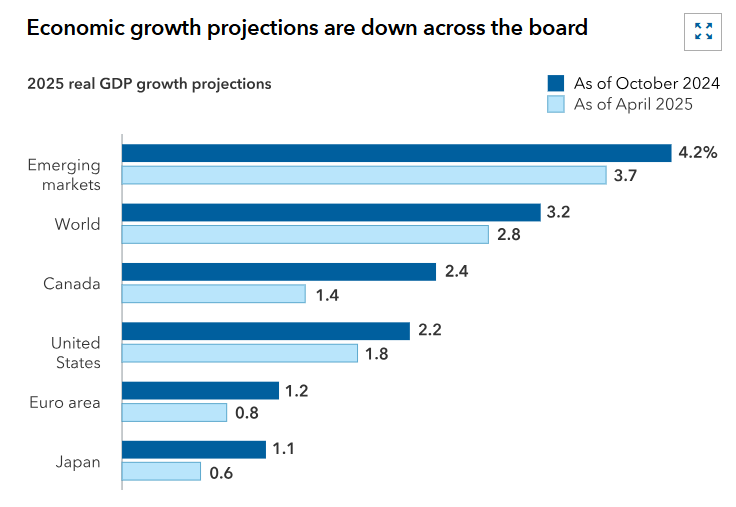

As policy uncertainty rises, global economic growth projections are falling. Downward revisions have been issued for the U.S., Europe, Japan and many emerging markets, based on the latest available figures from the International Monetary Fund. Recent trade negotiations involving the U.S., Europe and China are encouraging but much remains to be done.

“Many companies are hitting the pause button because they don’t know what the rules are going to be a week, a month or a year from now,” Capital Group economist Darrell Spence explains. “Even if some tariffs are ultimately lowered or rescinded, this pause effect is going to have an impact. Whether that pushes us into a recession or not remains an open question, but it raises the risk significantly.”

In some ways, the uncertainty has become an economic data point that must be taken into account, much as we look at other hard data such as employment, consumer spending and business investment, Spence adds. “I think so much of forecasting the economy right now is a forecast of policy. And that’s difficult to do when the policy can change so quickly.”

Market volatility returns in force

Market volatility has risen sharply in the first half of the year as the U.S. launched a series of new tariffs against virtually every trading partner, including Canada, Mexico and China. In a now familiar pattern, the news shook stock and bond markets, followed by powerful rallies when the tariffs were later reduced or paused.

By the end of May, U.S. stocks — as represented by the S&P 500 Index — had recovered nearly all of the earlier losses as investors turned a favorable eye toward the prospects for revised trade deals.

“We probably reached a point of maximum uncertainty in April,” says Jody Jonsson, a portfolio manager with New Perspective Fund®. That’s when the largest series of tariffs was announced on what President Donald Trump called Liberation Day. “Since then we’ve seen some encouraging progress. If we can resolve more of this uncertainty, markets may have a smoother ride in the second half of the year.”

Four scenarios for global realignment

Taking a step back and looking at the big picture, Jonsson observes that the world is clearly changing in ways we haven’t seen in decades. This global realignment — politically, militarily, economically — is disruptive and likely to remain so until a new order takes shape.

“We are in the middle of a fundamental restructuring of the geopolitical order as we’ve known it since the end of World War II,” she says. “The integrated global system we’ve come to rely on over the past several decades is rapidly changing, and it may look very different going forward.”

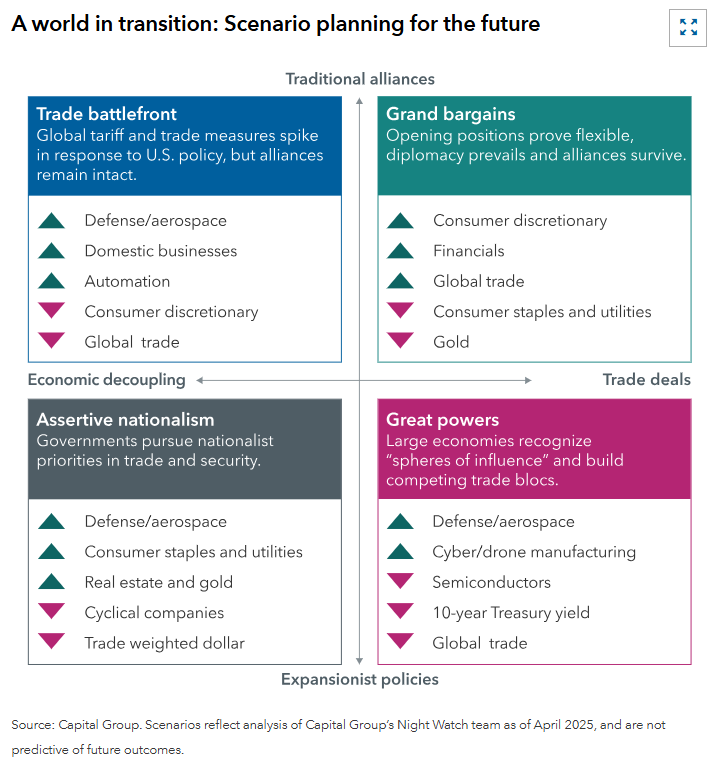

Capital Group’s Night Watch — a team of economists, political analysts and portfolio

managers — is seeking to understand these changes through scenario analysis. Rather than make predictions, they identify a range of potential outcomes, then connect them to investment implications.

In their initial analysis, they’ve identified four large-scale scenarios that could play out in coming years as the world seeks a new equilibrium. A global trade war and shifting political alliances could slow global economic growth, boost inflation and raise the risk of a recession. On the other hand, swift and successful trade negotiations could spark a market rally.

Much depends on the outcome of trade negotiations currently underway. But given their complexity and the vast number of trading partners involved, it could take a long time to hammer out the details, says Tom Cooney, Capital Group’s international policy advisor and a former diplomat with the U.S. Department of State.

“It took many years to build the post-war order, and it could be many more before a new order emerges,” Cooney explains. “Trade deals, in particular, normally take several years to negotiate, so I think we have a long journey ahead of us.”

Will central banks come to the rescue?

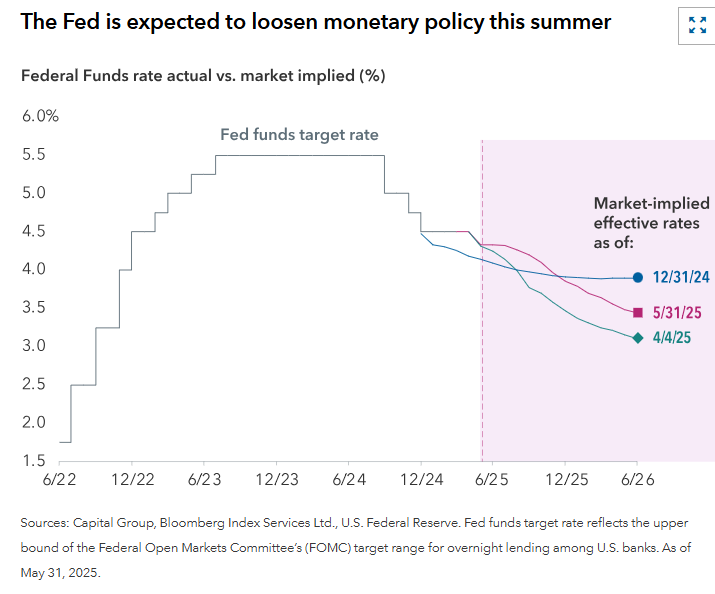

Officials at the world’s major central banks — chiefly, the U.S. Federal Reserve and the European Central Bank — are watching closely as these events unfold. The ECB has already started cutting rates, and many investors believe the Fed will too, as tariffs threaten economic growth. However, rising consumer prices are making that decision difficult, since lower rates could reignite inflation.

In the U.S., inflation has remained stubbornly high in recent months, hovering around 2.5% to 3% on an annualized basis. That’s above the Fed’s 2% target. Even so, bond investors are expecting the Fed’s first rate cut of the year to come in July, followed by two or three more before the end of the year.

“While the U.S. economy is showing some signs of slowing, employment remains strong, so the Fed probably isn’t likely to take action too quickly or too aggressively,” says Chitrang Purani, a portfolio manager with The Bond Fund of America®.

“As long as labor markets don’t materially weaken, the Fed has good reason to stay patient with inflation remaining above target,” Purani explains. He views current market pricing of the federal funds rate at around 3.8% by the end of the year, down from roughly 4.3% today, as a fair level based on the balance of risks.

“I do expect U.S. growth and global growth to slow in the face of tariffs and trade war uncertainty,” he adds, “but I think it’s too early to call for a recession.”

How to avoid a recession

What needs to happen for the U.S. and the world to steer clear of an economic downturn?

There are already signs that it won’t happen right away. Most of the economic data we’ve seen so far suggests that the U.S. economy will expand in the second quarter, Spence says. A 6% rise for the S&P 500 Index in May also indicates that investors aren’t expecting an immediate tariff-induced downturn.

“If the largest culprit for triggering a recession is a trade war, then dialing back the trade war is obviously a helpful step,” Spence says. “And it has been dialed back in the past few weeks. To remove the uncertainty, however, I think we would need to see an announcement that the trade war is over. Otherwise, it may be difficult to convince businesses and consumers to move forward with confidence.”

by: Darrell Spence, Jody Jonsson, Tom Cooney, Chitrang Purani

Recent Comments